Introduction

A tradable financial instrument with real-world value is called security. The securities market, which is worth hundreds of trillions, has the potential to grow even more by tokenizing those securities. This would improve the market’s efficiency and transparency, among other benefits.

If a business is looking to issue tokenized securities, they can do so with Polymesh, an institutional-grade blockchain that is built for regulated assets like security tokens.

What is Polymesh?

Polymesh was built to be a highly secure public permission blockchain that supports security tokens. These digital contracts represent fractions of assets with real-world value.

As a public network, anyone can view the network. However, you must verify your account to participate in the blockchain. This verification process applies to all actors in the chain, including issuers and investors, stakers, and node operators.

In order to run a node, you need to be a licensed, verified financial entity. This makes the network safer because these entities have more of an incentive not to cheat and cause damage than unidentifiable actors would.

Unlike permissioned ledger networks that can produce a great deal of friction for transactions, Polymesh networks enable participants to enjoy the unique benefits of privacy and transparency without compromising on trust.

How does Polymesh work?

Node operators and stakers work together to secure and validate blocks. Node operators who successfully validate blocks are rewarded in POLYX tokens. In order to ensure their node operators collect the commissions for their blocks, stakers stake their extra POLYX on the node operators of their choice. Monetizing investors can earn from participating in our network by collecting a commission of up to 10%.

Securing Polymesh

The blockchain company Polymesh deploys the Nominated Proof-of-Stake (NPoS) consensus model, which was developed by Polkadot. The system is designed to increase blockchain security as harmful behaviors will require evident effort and significant financial penalties. Through this mechanism, node operators and stakers are rewarded or fined in POLYX based on performance.

Polymesh’s fee structure

If a public permissionless blockchain varies in fees over time, it means that the cost to process some transactions will vary. For example, if transactions compete for space on the blockchain, this would likely incur higher fees. The processing of blockspace transactions will always have a higher fee than others because it’s competing for space with other blockspace transactions.

Polymesh’s low and consistent transaction fees are based on the size (in bytes) and complexity of the transaction, with Polymesh Governance having the ability to adjust the rate. It has a democratic system of management consisting of stakeholders and POLYX holders who govern Polymesh through the Polymesh Governing Council.

The Polymesh Governing Council sets protocol fees for certain native functions, such as reserving a token ticker. Fees are split at a 4:1 ratio between the Network Treasury – maintained by Polymesh Governance – and node operators. Network Treasury funds are typically used for improving or securing the network.

What makes Polymesh unique?

Polymesh is a layer 1 blockchain that has been built for tokens. Unlike many of the other projects focusing on security, Polymesh is its own sort of blockchain made from scratch.

Polymesh addresses the challenges that come with a poor infrastructure by providing a platform to solve problems related to government, compliance, security, confidentiality, and settlement.

Governance

We’ve built Polymesh on Substrate, which means that is forkless! In addition to these features, we also have an on-chain governance model that provides a council of key stakeholders to easily resolve any issues.

Identity

Polymesh is the most secure public blockchain in the world. With our mandatory identity verification process, every participant has an on-chain identity that cannot be recreated by anyone else. Our identities can be used to verify any needed data points, and they can also be traced back to known, real-world entities.

Compliance

The security tokens are built in to the base of the blockchain. Features like compliance and rules are optional, and can be automated and enforced at the token level with smart contracts.

Confidentiality

Polymesh’s MERCAT protocol enables confidential trades. Because Polymesh is a full stack, users retain trade privacy while remaining compliant with regulations.

Settlement

The on-chain settlement engine and two-way transaction authorization make it possible to settle both on-chain and off-chain assets. The near-instant, deterministic finality of the transactions ensures that there is a safe and secure transfer.

What is POLYX?

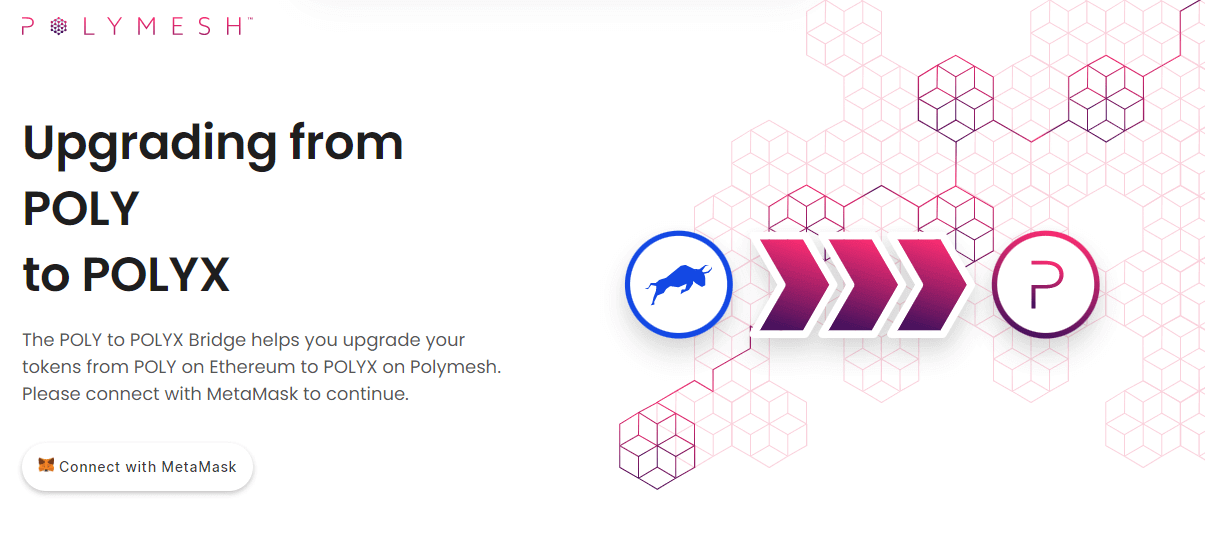

POLYX is the native token for Polymesh, and it is classified as a utility token under Swiss law. It also has legal backing by FINMA, the Swiss financial regulator. POLYX can be used for governance, securing the chain through staking, and creating security tokens.

Governance

Polymesh Governance has been developed in order to facilitate governance. Any verified POLYX token holder can influence Polymesh’s direction in two ways: by submitting a Polymesh Improvement Proposal (PIP) or by voting using POLYX tokens. To submit a PIP, users have to bond their tokens to it. Once approved, PIPs are voted on by the Governing Council for implementation.

Staking

If you’re a verified POLYX holder, you can choose to stake your PLX by bonding it to the operator of your choice. By doing so, you’ll help increase their chances of winning rewards and thus make more money in the process.

The Polymesh ecosystem

Polymesh’s ecosystem provides participants with a network of interconnected parties. In this shared space, you can find cryptocurrency exchanges, experienced players in the tokenization space (Polymath), and companies with sizable security token portfolios (Redswan). The Polymesh Association helps encourage more development through two programs:

-Security Token Accelerator for SMEs

-Regulatory Compliance Protocol for traders

If you’ve been working to develop features and functionality for Polymesh and need funding, Polymesh offers the Grants Program. This will go to individuals or businesses that are working together to improve Polymesh.

The Ecosystem Development Fund for businesses with closed-source technology that integrate Polymesh.

Polymesh is a great option for developers. You’ll find plenty of information available, including our SDK library and community support channels.

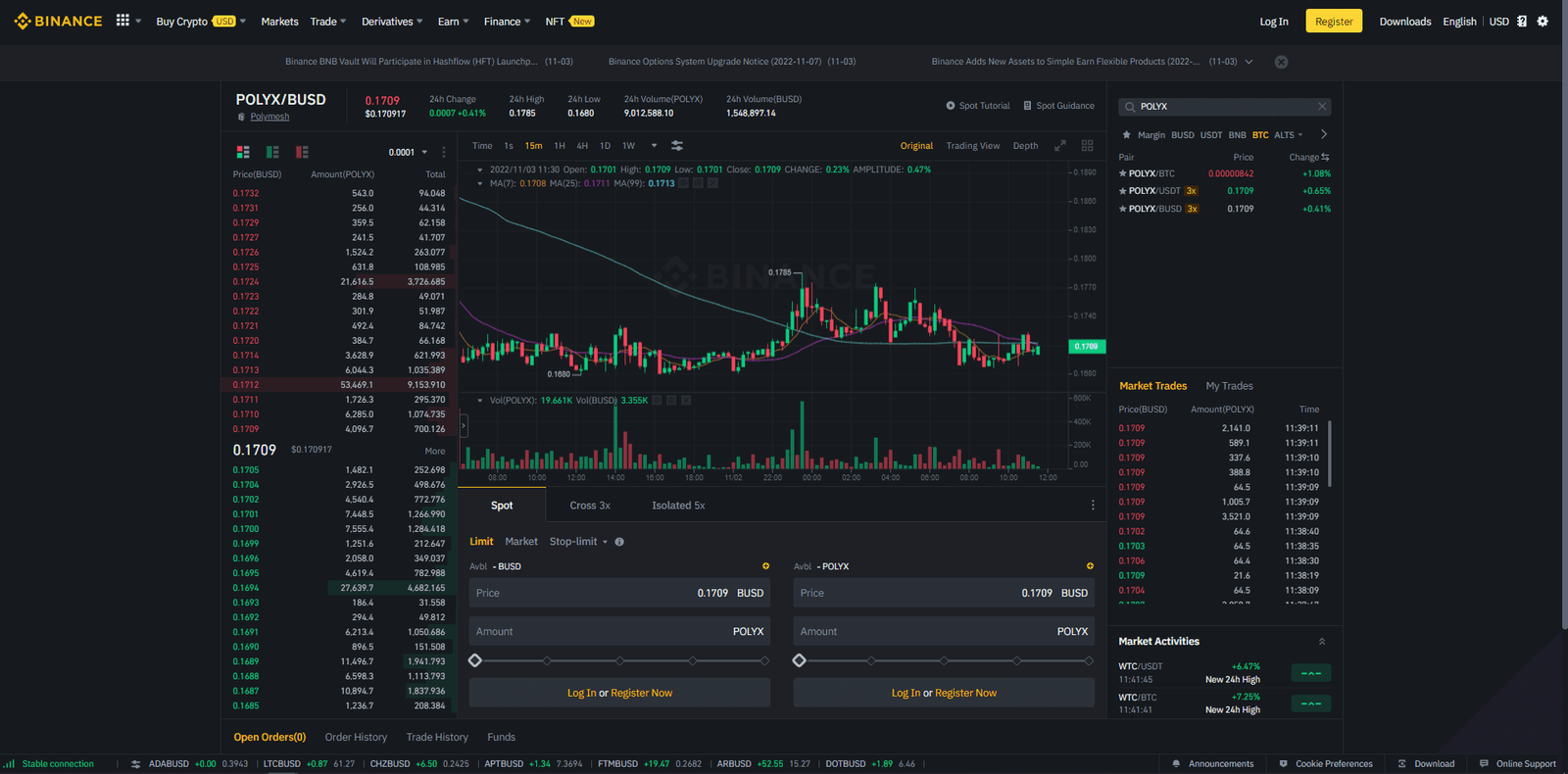

How to buy POLYX on Binance?

1. Log into your Binance account and go to the [Trade] -> [Spot] button.

2. Go to the trading pairs page and type “POLYX” in the search bar. We’ll use POLYX/BUSD as an example.

3. In this example, we will use a market order. Go to the [Spot] box and enter the amount of POLYX you want to buy. Click [Buy POLYX] to confirm your purchase, and your purchased POLYX will be credited to your Spout Wallet.

We’ve come to the end of our article.

Polymesh is also working hard to improve security tokens and the systems that surround them. This includes the stability of a cryptocurrency, implementing non-fungible tokens (NFTs), secrecy through MERCAT protocol, and simpler user onboarding.